Being investigated for a white-collar crime in Texas can be terrifying, and the legal terms thrown around can feel like a foreign language. Two terms that often get mixed up are fraud and embezzlement. While they might seem similar, the core difference boils down to one simple idea: trust.

Think of it this way: fraud is about tricking someone to get something of value. Embezzlement is about stealing something you were already trusted to hold. Understanding this distinction isn't just a legal technicality—it’s the first and most critical step in building a defense that protects your rights and your future. But you don’t have to face it alone.

A Clear Comparison of Fraud vs. Embezzlement

While both fraud and embezzlement fall under the umbrella of theft in the Texas Penal Code, the prosecution’s game plan for each is completely different. The entire case hinges on a single question: did you have legal access to the property before it went missing?

Fraud is a broad category covering all sorts of deceptive schemes designed for financial gain. Embezzlement, on the other hand, is much more specific. It happens when someone who was given lawful control over assets—like an employee, a treasurer, or a trustee—decides to take them for themselves. You can learn more about the impact of these financial crimes in the 2024 Report to the Nations.

This distinction is everything because a prosecutor has to prove a completely different set of facts for each charge.

To make it crystal clear, let's lay out the key differences.

| Feature | Fraud | Embezzlement |

|---|---|---|

| The Core Action | Deception or trickery to get assets you had no right to. | A breach of trust involving assets you were legally holding. |

| Initial Access | You never had legal access to the money or property. | You were given lawful control over the money or property. |

| Relationship to Victim | Can be a total stranger or a business acquaintance. | Almost always involves a fiduciary relationship (employee, trustee, etc.). |

| Real-World Example | Using a stolen credit card or faking a car accident for an insurance payout. | A bookkeeper quietly moving company funds into their own bank account. |

Why This Distinction Is the Key to Your Defense

Understanding whether you're facing a fraud or an embezzlement charge is the bedrock of your entire legal strategy. It dictates every move we make to protect you.

If the charge is fraud, the defense often centers on proving there was no intent to deceive. Maybe it was a simple mistake, a misunderstanding, or you genuinely believed the information you provided was accurate.

But for an embezzlement charge, the fight is different. We might argue that you had authorization to use the funds in that way, or perhaps that a true fiduciary duty never legally existed in the first place.

At The Law Office of Bryan Fagan, PLLC, we dig into the details of the accusation to find the weak spots in the prosecutor's case. Whether their argument rests on a claim of deception or a breach of trust, we know exactly how to build a defense tailored to fight the specific charge you’re up against.

Breaking Down Fraud Charges Under the Texas Penal Code

When you're accused of a crime, the first step in building a defense is understanding exactly what the prosecution has to prove. In Texas, fraud isn't a single crime; it's a whole category of offenses built around one core idea: deception for financial gain. To get a conviction, the state must show—beyond a reasonable doubt—that you acted with a specific, fraudulent intent.

The heart of any fraud charge lives in Texas Penal Code Chapter 32. While this chapter covers a lot of ground, all the offenses share common threads. The prosecutor’s job is to build a case proving you intentionally used deception to unlawfully take property, services, or money from someone else.

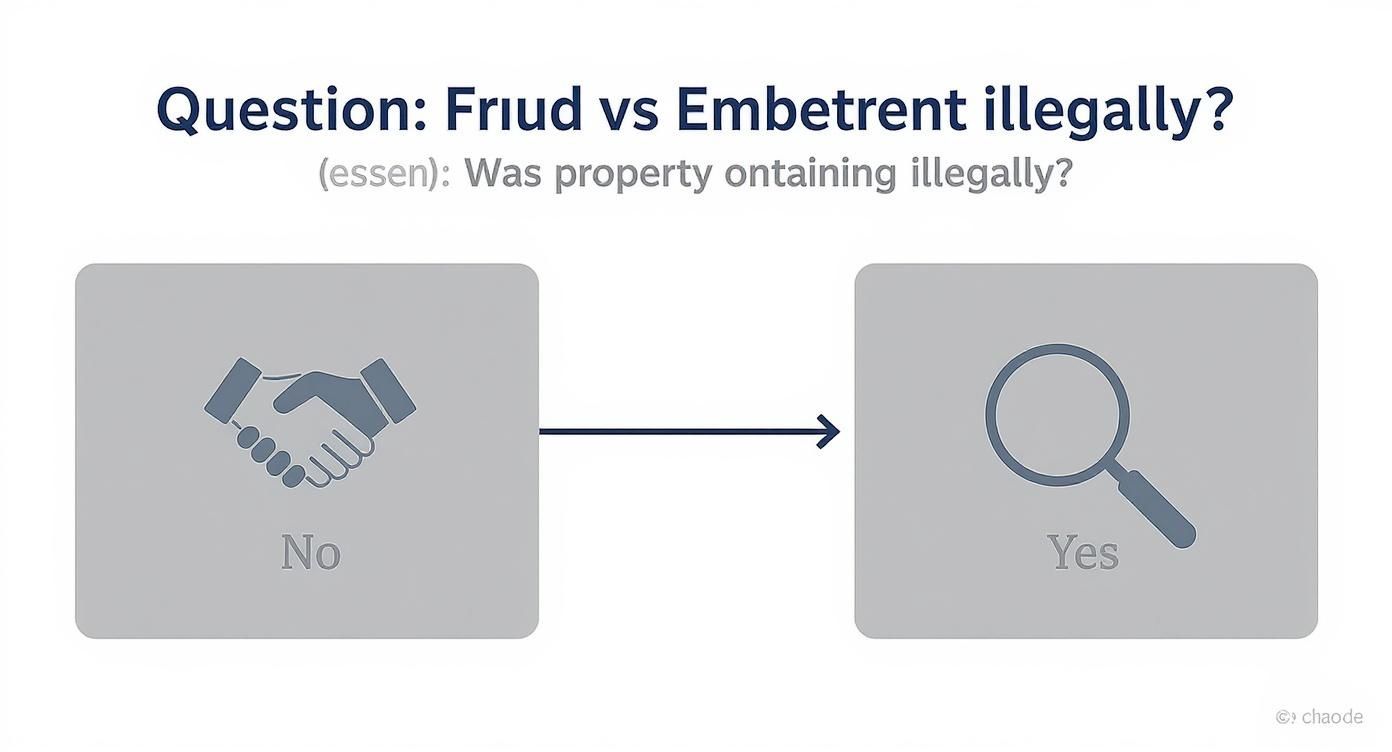

This decision tree visualizes the fundamental question that separates fraud from embezzlement: how was the property initially accessed?

As you can see, fraud kicks off with an illegal or deceptive act to get the property in the first place. Embezzlement, on the other hand, starts from a position of lawful access. This initial difference is critical and shapes the entire legal battle that follows.

The Three Pillars of a Fraud Case

For a prosecutor to prove fraud in a Texas courtroom, their case must stand firmly on three essential elements. If we can show that even one of these pillars is weak, their entire case against you can fall apart.

- Deception: This is the act of knowingly creating a false impression. It can be a direct lie, a misleading statement, or even just failing to correct a false impression you know someone else has.

- Intent: This is often the make-or-break element for the state to prove. They have to show that you intended to deceive the victim to get their property. An honest mistake isn't fraud. A misunderstanding isn't fraud.

- Unlawful Appropriation: This simply means you actually acquired the property or money without the owner’s effective consent. The key word here is "effective"—consent given because of a lie or trick isn't legally valid.

Understanding these elements is everything. Our defense strategy often focuses on dismantling the prosecution's claims about your intent. We work to show the jury that what happened wasn't some calculated scheme but maybe a misunderstanding or a business deal that just went sour. For a deeper look into how these laws are structured, check out our guide to understanding the Texas Penal Code.

Common Types of Fraud Charges in Texas

The general definition of fraud gets applied to many different situations, which leads to the specific charges you might face. While the circumstances can vary wildly, the core elements the prosecution has to prove stay the same.

Some of the most common examples include:

- Credit Card Fraud: Using someone’s credit or debit card without their permission, or even using your own card when you know it's going to be declined.

- Insurance Fraud: Filing a false insurance claim, like exaggerating injuries from an accident or staging a theft just to get a payout.

- Securities Fraud: Lying to investors about a company's financial health to manipulate stock prices.

- Check Fraud: Writing a "hot check" from an account you know has insufficient funds or, more seriously, forging someone's signature on a check.

The prosecution's case isn't just about showing that someone lost money. They must directly connect that loss to your specific, intentional act of deception. Without that proven connection, they don't have a case. Facing any of these charges is overwhelming, but remember that an accusation is not a conviction. At The Law Office of Bryan Fagan, PLLC, we meticulously examine every piece of evidence to challenge the state’s narrative and protect your rights.

How Texas Law Defines and Prosecutes Embezzlement

Embezzlement is a unique brand of theft, one that often feels more like a personal betrayal because it’s built on a foundation of broken trust. If you're facing this kind of accusation, it's critical to know that Texas doesn't have a specific law called "embezzlement." Instead, the state prosecutes these acts under its general theft statutes in the Texas Penal Code, but there's a crucial twist that sets it apart from a typical theft case.

The entire prosecution hinges on the concept of a fiduciary duty. It sounds like a complex legal term, but it just means you were put in a position of trust and responsibility over someone else’s property or money. The prosecutor’s job is to prove you didn't just take the assets—you betrayed that specific legal trust in the process.

Unlike a stranger committing fraud, an embezzlement charge almost always involves someone who had lawful access to the funds they're accused of stealing. This "insider" status is what truly defines the offense.

The Core Element: A Breach of Trust

To get a conviction, a prosecutor must prove you were entrusted with property and then unlawfully took it for your own benefit. This act of "entrustment" is the key legal ingredient that turns a theft charge into an embezzlement case, even though it's all handled under the Texas Penal Code.

This breach of trust can pop up in all sorts of professional and personal settings. The core idea is simple: you were given legitimate control over assets for one reason but decided to use them for another, unauthorized purpose.

Think about these common scenarios where embezzlement charges surface:

- A Company Accountant: An accountant with access to corporate bank accounts might create phony invoices and funnel payments directly into their personal account.

- A Non-Profit Treasurer: The treasurer for a local charity could dip into donated funds to cover personal bills, like a car payment or a vacation.

- An Estate Trustee: Someone appointed to manage a family trust might illegally withdraw funds for themselves instead of distributing them to the rightful beneficiaries.

- A Retail Manager: A manager responsible for daily cash deposits could skim money off the top before ever making it to the bank.

In every one of these examples, the person had a right to handle the money. They just didn't have the right to take it for themselves.

How Embezzlement Cases Are Investigated and Built

Because embezzlement is an "insider crime," the investigations are often complex and sink or swim based on the financial records. Understanding how these charges are pieced together means recognizing the role of experts who specialize in forensic accounting. Investigators will meticulously trace the money, hunting for irregularities, unauthorized transactions, and any attempts to cover up the paper trail.

The profiles of fraud and embezzlement offenders highlight some important distinctions. While pretty much anyone can commit fraud, embezzlement is almost exclusively an insider's game. The Association of Certified Fraud Examiners discovered that fraud committed by owners or executives causes far larger median losses ($459,000) compared to rank-and-file employees. These schemes can fly under the radar for years precisely because the person's trusted position helps them avoid detection. You can learn more about these trends and their impact from this in-depth analysis of white-collar crime statistics.

The prosecution must prove not just that money is missing, but that you—and only you—used your position of trust to intentionally and unlawfully take it. Any doubt about who was responsible or whether you had permission can create a powerful defense.

At The Law Office of Bryan Fagan, PLLC, we know how to scrutinize that paper trail and dismantle the prosecution's story. We dig into whether other people had access, whether you actually had authorization for the transactions, or if the whole situation was just a product of sloppy bookkeeping rather than criminal intent. Your defense starts with understanding the unique nature of an embezzlement allegation.

Comparing Penalties for Fraud and Embezzlement

When you’re facing a criminal charge, the first thing you want to know is what’s at stake. In Texas, the penalties for both fraud and embezzlement aren't based on the name of the crime. Instead, they hinge on a single, critical factor: the total value of the money or property involved.

The law makes no distinction between a dollar stolen through a clever lie and a dollar stolen through a breach of trust. When it comes to punishment, a theft is a theft, and both fraud and embezzlement are graded under the exact same penalty structure in the Texas Penal Code. This means whether you're accused of complex insurance fraud or simple employee embezzlement, the potential sentence climbs right alongside the financial value of the alleged crime.

The Texas Theft Penalty Tiers

The Texas Legislature created a clear, value-based ladder for theft offenses. As the dollar amount goes up, the charge escalates from a minor misdemeanor to a life-altering felony. It's a system designed to make the punishment fit the financial harm.

And the financial harm is staggering. In 2024 alone, reported fraud losses across the U.S. skyrocketed to over $12.5 billion. While embezzlement is often an internal company problem, its impact is massive, with the average loss per incident hitting $357,650—often leading to devastating consequences like employee layoffs. You can dig deeper into these numbers with the Federal Trade Commission's latest data.

To give you a clear picture of what this means for your criminal case, here’s a breakdown of how the value of stolen property translates into specific charges and penalties in Texas.

Texas Theft Penalty Tiers

This table outlines the criminal charges and potential sentences for theft-related offenses in Texas, determined by the total value of the money or property involved.

| Value of Stolen Property or Money | Charge Level | Potential Jail or Prison Time | Maximum Fine |

|---|---|---|---|

| Less than $100 | Class C Misdemeanor | None | Up to $500 |

| $100 to $750 | Class B Misdemeanor | Up to 180 days in jail | Up to $2,000 |

| $750 to $2,500 | Class A Misdemeanor | Up to 1 year in jail | Up to $4,000 |

| $2,500 to $30,000 | State Jail Felony | 180 days to 2 years in state jail | Up to $10,000 |

| $30,000 to $150,000 | Third-Degree Felony | 2 to 10 years in prison | Up to $10,000 |

| $150,000 to $300,000 | Second-Degree Felony | 2 to 20 years in prison | Up to $10,000 |

| More than $300,000 | First-Degree Felony | 5 to 99 years (or life) in prison | Up to $10,000 |

As you can see, the stakes get incredibly high, very fast. A theft of just $2,500 is all it takes to cross the line into felony territory, which brings the risk of prison time and the permanent loss of certain civil rights.

Aggravating Factors That Increase Penalties

While the dollar value is the main driver, certain circumstances can automatically bump the charge up to the next level. Prosecutors call these aggravating factors, and they look for them to increase the severity of a case.

The most common enhancer involves the victim's age. If the alleged victim is an elderly individual (someone 65 or older), the penalty is automatically kicked up a notch. For example, a theft that would normally be a Class A Misdemeanor becomes a State Jail Felony if the victim is elderly.

Other aggravating factors include:

- The victim was a non-profit organization or a government entity.

- The defendant was a public servant who used their official position to commit the crime.

The critical takeaway here is that the penalties for fraud and embezzlement are identical and tied directly to value. But the context of the alleged crime—especially who the victim is—can dramatically increase the punishment you face.

Understanding what is at stake is the first step toward building a defense. At The Law Office of Bryan Fagan, PLLC, we analyze every detail of the accusation to fight for a reduction or dismissal of the charges, always aiming to protect your freedom and your future.

Strategic Defenses for White-Collar Crime Allegations

An accusation of a white-collar crime can make you feel like the world is closing in, but you have to remember one fundamental truth: an accusation is not a conviction. Just because the state has brought charges against you doesn't mean its case is airtight. A skilled criminal defense team can build a powerful strategy designed to dismantle the prosecution’s arguments, piece by piece.

Whether you are facing allegations of fraud or embezzlement, the path to protecting your freedom starts with a proactive and strategic defense. Plenty of effective defenses exist, and the right one for your case will depend entirely on the specific facts and whatever evidence the prosecution claims to have.

Common Defenses for Both Fraud and Embezzlement

While fraud and embezzlement are different crimes, several powerful defense strategies can work against both types of allegations. The prosecution carries the entire burden of proof, and if we can create reasonable doubt about any single element of their case, we can win.

Some of the most common and effective defenses include:

- Lack of Intent: This is often the cornerstone of a white-collar defense. The prosecutor must prove you intended to deceive or steal. We can argue that your actions were the result of an honest mistake, a misunderstanding of complex financial rules, or simply poor judgment—none of which are criminal.

- Consent or Authorization: If you had permission from the property owner to conduct the transaction, it isn't a crime. This is especially relevant in embezzlement cases, where we might show you had the authority to use the funds, even if the bookkeeping was messy.

- Duress or Coercion: This defense argues that you were forced to commit the act against your will due to threats of harm to you or your family. If you didn't act of your own free will, you may not be held criminally responsible.

- Mistaken Identity: In complex financial cases involving multiple parties, it’s entirely possible for the wrong person to be accused. We can work to show that someone else was responsible for the alleged criminal activity.

Defenses Specifically for Fraud Allegations

When the charge is fraud, the entire case rests on the idea of deception. Your defense, therefore, has to focus on shattering that narrative. It's not enough for the prosecution to show that someone lost money; they must prove you intentionally tricked them into it.

The core of a fraud defense is often proving the absence of a scheme. By showing that your actions were transparent, based on good faith, or the result of a legitimate business deal that just didn't work out, we can effectively challenge the prosecution’s claim of intentional deception. A forensic accountant can be an invaluable asset here, helping to analyze records and support your side of the story.

Defenses Specifically for Embezzlement Allegations

For an embezzlement charge, the prosecution's case is built on a breach of trust. The key is to challenge the existence of that trust relationship or to prove you never violated it in the first place.

Defenses unique to embezzlement often zero in on two key areas:

- No Fiduciary Duty: We may argue that you never legally held a "fiduciary" position. If you weren't officially entrusted with the assets in a way the law recognizes, then the core element of embezzlement is missing.

- Claim of Right: This defense asserts that you had a good-faith belief that you were entitled to the property. For example, you may have genuinely believed the funds were owed to you as a commission or bonus.

Ultimately, a strong defense can sometimes lead to favorable outcomes without ever going to trial. Options like pretrial diversions or deferred adjudication in Texas can result in the charges being dismissed after a period of probation, protecting your permanent record. If you are under investigation, it is crucial to avoid speaking with investigators or your employer without your attorney present. The sooner you have a legal advocate on your side, the more effectively we can protect your rights.

Protecting Your Future After a Criminal Charge

Facing a fraud or embezzlement charge can make you feel like your future is over before it’s begun. It’s easy to think a conviction is the end of the line, but it doesn't have to be. Texas law offers powerful legal paths to help you move on by clearing your criminal record. We're here to defend you today, but just as importantly, we’re committed to helping you rebuild your life for tomorrow.

Navigating the immediate aftermath of a charge is a complex process. Understanding procedural steps like mastering the bail application format is critical, but so is knowing what options you have once the case is resolved.

Expunctions: Wiping the Slate Completely Clean

The gold standard for clearing your name is an expunction. This isn't just about sealing a record; it's about completely destroying it. When a court grants an expunction, it's as if the arrest and charge never happened in the eyes of the law.

You might be eligible for an expunction if:

- Your case was ultimately dismissed.

- A jury found you "not guilty" at trial.

- You successfully finished a pretrial diversion program.

- You were convicted but later received a pardon.

Once the expunction goes through, you can legally deny the arrest ever occurred on job applications, housing forms, or anywhere else. It truly is a fresh start.

Orders of Nondisclosure: Sealing the Record from Public View

What if an expunction isn't on the table? An order of nondisclosure might be the next best thing. This court order seals your criminal record from the public, effectively hiding it from private employers, landlords, and credit agencies.

This option is often available for people who successfully complete deferred adjudication probation. While the record is sealed from public view, it's important to know that it remains accessible to law enforcement, government agencies, and some licensing boards. Still, it's a huge step toward restoring your privacy and professional life.

The path to a clean record is highly specific and depends entirely on how your case concludes. An experienced attorney can look at the details of your situation, figure out if you qualify, and handle the complex filing process for you. Knowing how to get charges dropped is a good starting point, as a strong defense can set you up for a better outcome and improve your chances of clearing your record down the road.

Answers to Your Questions About Texas Fraud and Embezzlement Cases

When you're caught in the middle of a white-collar crime investigation, the questions and anxieties can pile up fast. Below, we've answered some of the most urgent questions we hear from people facing fraud and embezzlement allegations in Texas.

Can I Be Charged with Embezzlement if I Intended to Pay the Money Back?

Yes, you absolutely can. The hard truth is that Texas law zeroes in on your intent at the moment you took the property. A prosecutor only needs to prove that you intended to deprive the owner of their property unlawfully, even if you genuinely planned to return it later.

The unauthorized taking is the crime. Your plan to make things right down the road isn't a legal defense to the act itself.

What Should I Do if I'm Being Investigated but Haven't Been Charged Yet?

Call an experienced criminal defense attorney immediately. This is a critical window where a lawyer can shield your rights and potentially shape the outcome before charges are ever filed.

Do not talk to investigators, the police, or even your employer about the situation without your lawyer present. Anything you say can and will be used against you. Your attorney can manage every communication on your behalf, ensuring your interests are protected from the very beginning. Your most important move is to stay silent and get legal counsel.

How Can a Criminal Defense Lawyer Help in a Complex Financial Crimes Case?

In cases like these, an experienced lawyer isn't just helpful—they're essential. A skilled Texas criminal defense attorney will:

- Analyze the Evidence: Meticulously review every financial document, looking for holes in the prosecution's story and challenging their interpretation of the evidence.

- Collaborate with Experts: Work with forensic accountants and other experts to uncover inconsistencies, sloppy bookkeeping, or alternative explanations for the missing funds that investigators may have missed.

- Negotiate with Prosecutors: Point out weaknesses in the state’s case to argue for a dismissal, reduced charges, or a more favorable plea agreement.

Ultimately, a defense attorney builds a strategy tailored to the specific facts of your case. Their goal is to fight for your freedom, protect your reputation, and secure your future.

If you’ve been charged with a crime in Texas, call The Law Office of Bryan Fagan, PLLC for a free and confidential consultation. Our defense team is ready to protect your rights.